Facebook’s 9 month transformation

How did so many investors get Meta so wrong?

With threads.net reaching 100M+ signups in 5 days, Meta has reached $313 per share and has exploded this year. Their stock price has grown by 151% year to date, and even more since their lowest point at $88 in November 2022.

How did so many people get Meta so wrong? Let’s revisit what the narrative was for Meta’s stock price in November 2022.

In this 3 minute video, Cramer chokes up saying “Let me say this…I made a mistake here. I was wrong…I trusted this management team…I had thought there’d be an understanding that you just can’t spend and spend right through your free cash flow, that there had to be some level of discipline.”

As awesome as it is to dunk on Jim Cramer and take the opposite side on all of his trades, what he is saying is not wrong. Let’s look at the financial reports.

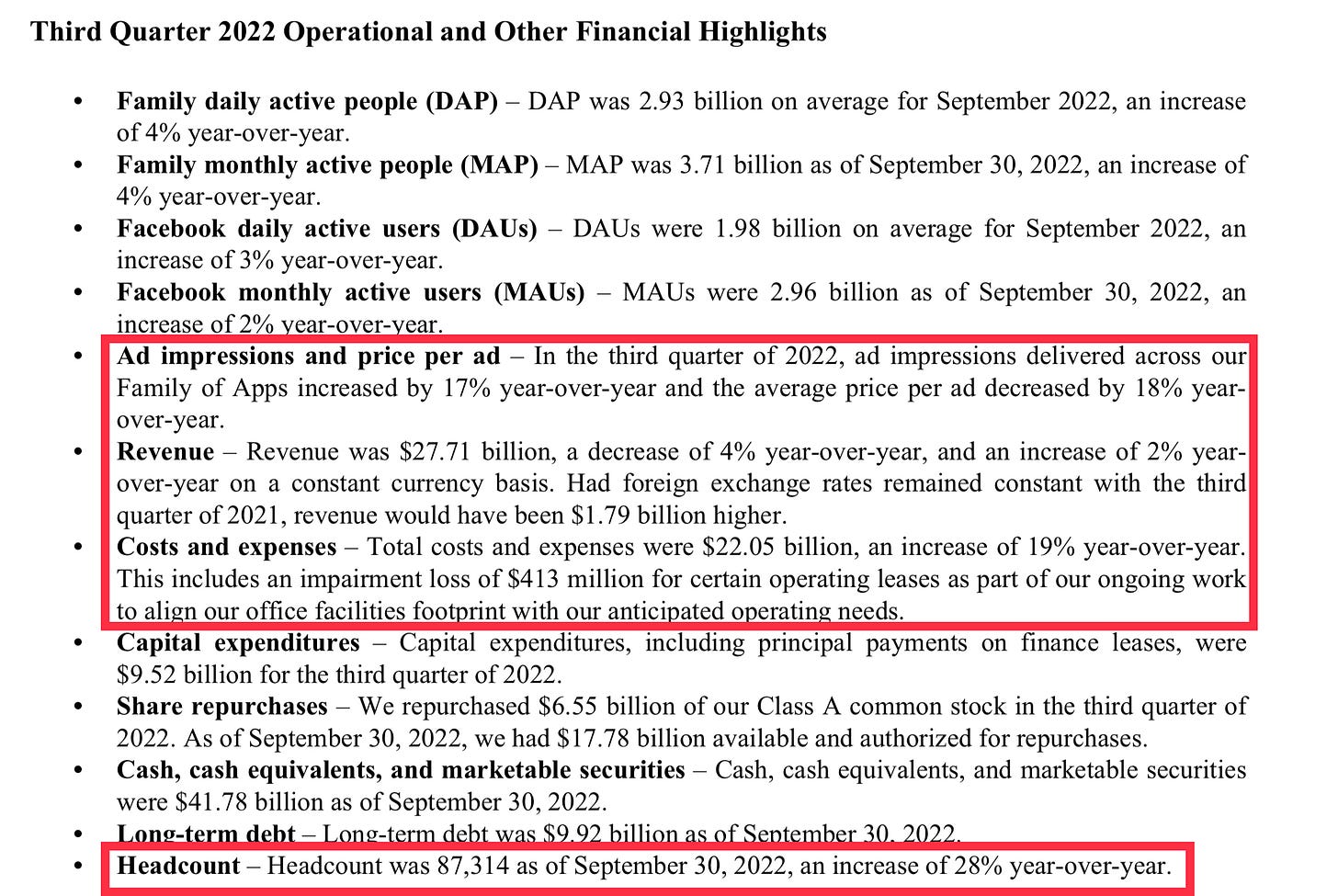

Q3 2022

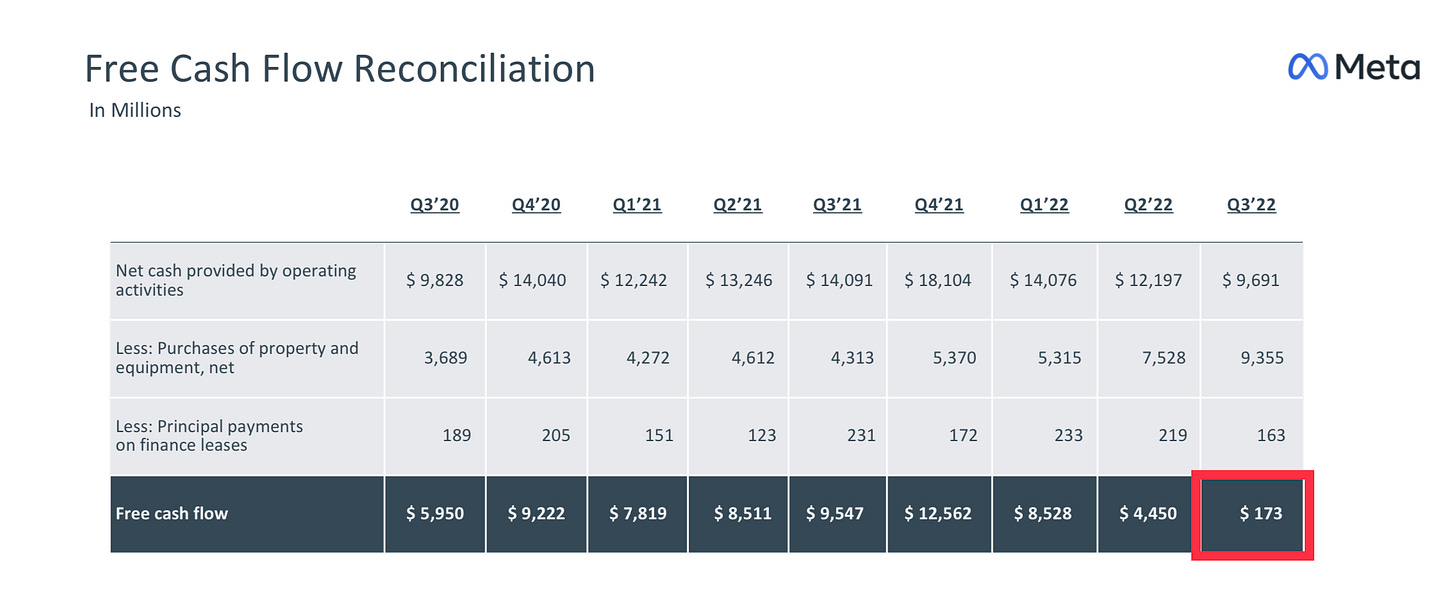

Free cash flow fell off a cliff this quarter. Meta was usually a 30% operating margin business, and FCF almost became $0, while dumping $13B annually into the metaverse and not materializing into meaningful revenue. Simultaneously, Apple required apps to ask users to give them permissions to track them. This reduced ad effectiveness because Meta could no longer determine whether an ad resulted in a conversion or purchase. TikTok looked like a big threat that was eating their lunch. Ad impressions were increasing dramatically while price per ad was falling. Meta was no longer allowed to acquire companies. People who wanted to do great work no longer wanted to be at Meta because of the bureaucracy and “promotion driven development” cycle.

But was Meta structurally a different business than before? After this earnings report, Mark published a memo calling for 2023 to be the “Year of Efficiency.”

“Before getting into our product priorities, I want to discuss my management theme for 2023, which is the "year of efficiency". We closed last year with some difficult layoffs and restructuring some teams. When we did this, I said clearly that this was the beginning of our focus on efficiency and not the end. Since then, we've taken some additional steps like working with our infrastructure team on how to deliver our roadmap while spending less on capex. Next, we're working on flattening our org structure and removing some layers of middle management to make decisions faster, as well as deploying AI tools to help our engineers be more productive. As part of this, we’re going to be more proactive about cutting projects that aren't performing or may no longer be as crucial, but my main focus is on increasing the efficiency of how we execute our top priorities.”

Source, Feb 1, 2023

“I believe we are deeply underestimated as a company today. Billions of people use our services to connect, and our communities keep growing. Our core business is among the most profitable ever built with huge potential ahead. And we’re leading in developing the technology to define the future of social connection and the next computing platform. We do historically important work. I’m confident that if we work efficiently, we’ll come out of this downturn stronger and more resilient than ever.”

Source, Nov 9, 2022

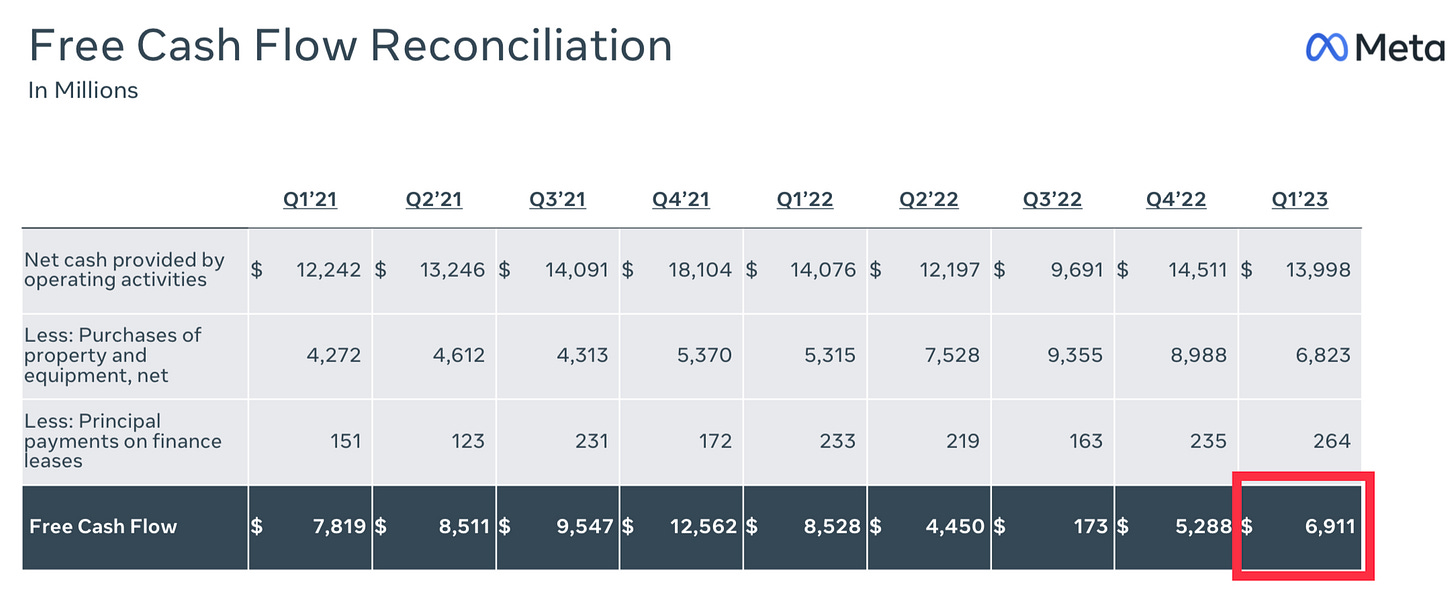

And those statements translated into results. I believe they will continue to translate into amazing results for Meta employees and shareholders alike. Let’s look at Q1 2023.

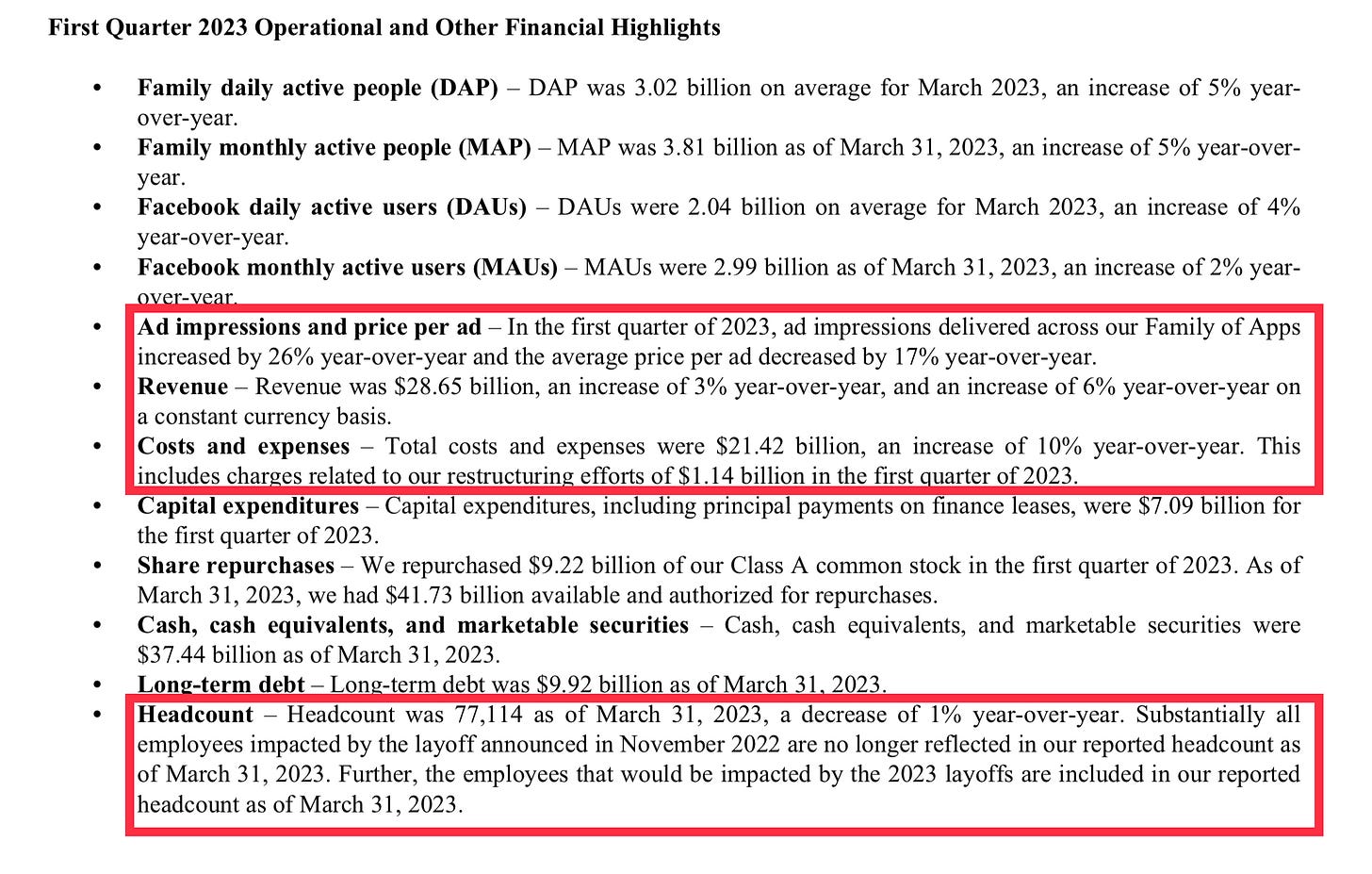

Q1 2023

Ad impressions are still at all-time highs, but the narrative switched — primarily because daily usage remained high despite the TikTok threat. Reels was taking off as a good-enough substitute for TikTok.

And the company was doing this with far fewer headcount, with no plans on hiring a large number of additional people, cutting staff from 87,000 to 77,000, which is likely still too many employees. Threads was launched with a team of dozens of people.

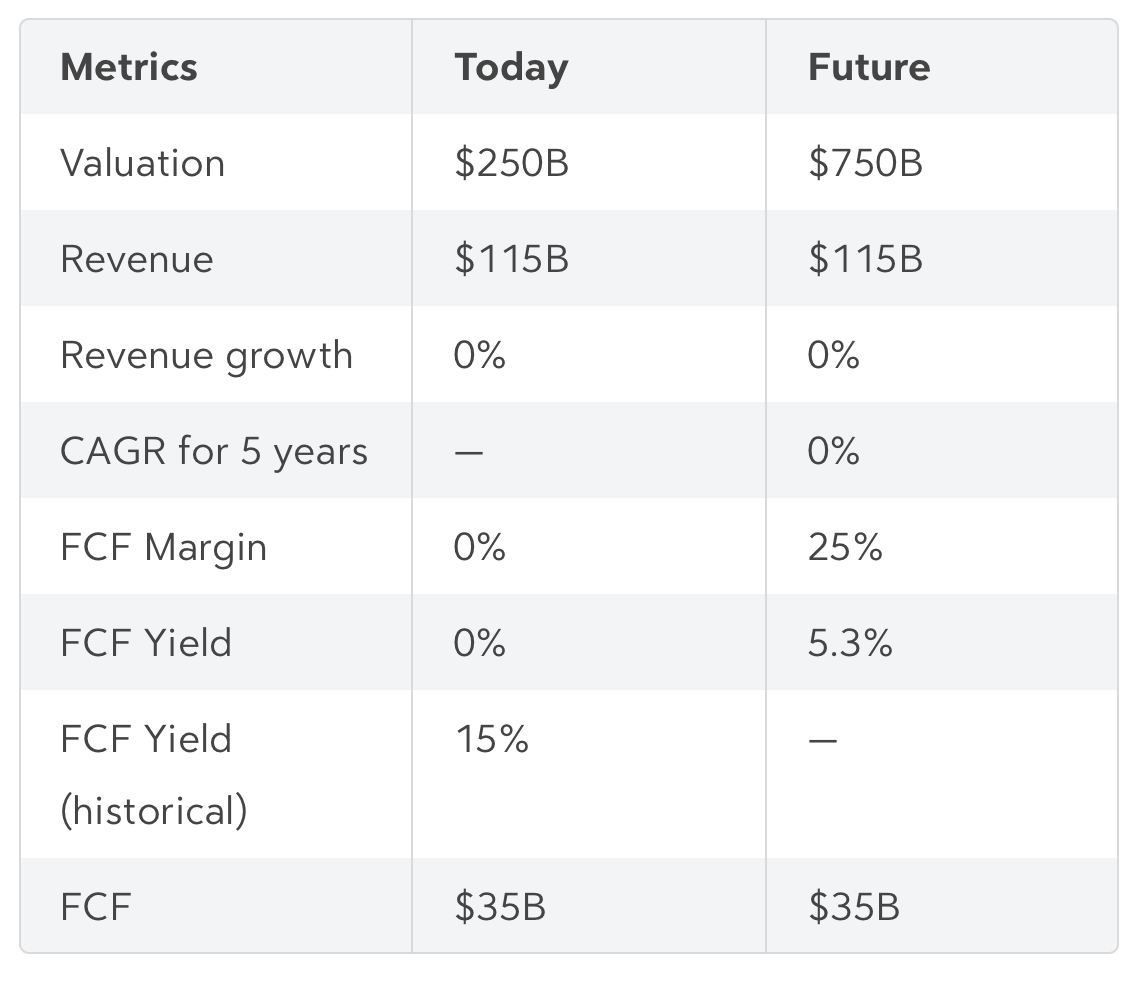

Let’s summarize the financial picture from Q3 2022 to now.

A simple investing framework

To get to 3x return from the lows of November 2022, you had to believe three things.

The $0 FCF quarter was only temporary — this requires belief that Mark would reign in costs dramatically.

After reigning in costs, operating profit would return to historical levels — this requires belief that the TikTok threat would be mitigated and Apple’s IDFA restriction would hurt everyone in the industry equally, resulting in similar advertising spend attributed to Meta properties.

After steady state is achieved again, Meta would trade at a normal big tech multiple — this requires belief that Meta belongs as a member of the Microsoft, Apple, Google, Amazon family, with the best talent to take advantage of new enabling technologies such as generative AI, and the reach to affect billions of users.

All of these became true. Meta trades at 40 P/E, with 5% FCF yield if you assume historical FCF returns (which matches the quarterly trend). Meta releases LLaMa as an open source generative AI model. Threads launches at the exact right time as Twitter makes its biggest mistake. Apple announces the Vision Pro, validating Quest metaverse investments and gives them a roadmap of interface features to copy. TikTok is no longer taking obscene share of attention from Instagram. Click to message ads, which include WhatsApp monetizaion, is earning at a $10B revenue run rate.

What could be next for Meta?

Meta’s future roadmap

As an armchair CEO with no qualifications to make these claims, here’s what I think Meta could do to simplify their strategy and double down on what’s working, called SABA — Shopify, Apple, Boomers, AI.

Copy Shopify — there is no reason storefronts should be using their own websites instead of using Meta properties to sell their catalog of items. This is especially true with Facebook Pay, Facebook pages, Facebook Marketplace, and other assets they have at their disposal to take this market.

Copy Apple — now that Apple has shown the way for what the app ecosystem and interaction model should look like for AR and VR, Meta can copy the interface controls immediately. This is especially true for the “spatial click” which is simple and genius.

Keep the Boomers — the moneymaker for Meta is in the advertising model for newsfeed, stories, and reels. Since Facebook’s invention, there have been so many social media platforms that have come and gone — Myspace, Friendster, Path, AIM, MSN Messenger, Google+, Houseparty, Marco Polo, Skype, Yammer, Slack, Musical.ly, Periscope, Vine, YikYak, Digg, Stumbleupon, BeReal, Clubhouse, FourSquare, Pinterest, Nextdoor, Tumblr, Truth Social, Parler, Mastodon, BlueSky. Competitors remain in TikTok, Snapchat, WeChat, Twitter, Telegram, Reddit, Discord, and Teams. You get the idea. Meta acquired WhatsApp and Instagram and kept both at more than a billion daily active users, and Meta is here to stay. If they keep the users who make purchases, Meta’s moneymaker will be here to stay as well.

Invest in AI — Historically, Meta and Google have constantly fought over AI research scientists and graduate students, with both companies dominating the academic space with the sheer number of published papers regarding AI. As long as they can continue to keep this technology lead, and also embed that technology into their core products, Meta will continue to be an AI leader and take advantage of this new paradigm of computing. Once generative AI agents are embedded into messenger, IG chat, and WhatsApp, the roof is going to come off Meta’s stock price.

As long as Meta keeps to this framework, and continues to improve cost controls (i.e. middle manager layoffs), they will be a force to come for a long time. Especially if Mark keeps posting Jiujitsu and boxing videos. I’d like to not have shirtless billionaires in my social media feeds, but it’s the price I’ll pay for a rising stock price.

If you enjoyed this piece, I would love if you could subscribe and share my work!